Integrated Intelligence for Reinsurance

Break data silos. Elevate insights. Leverage beyond AI.

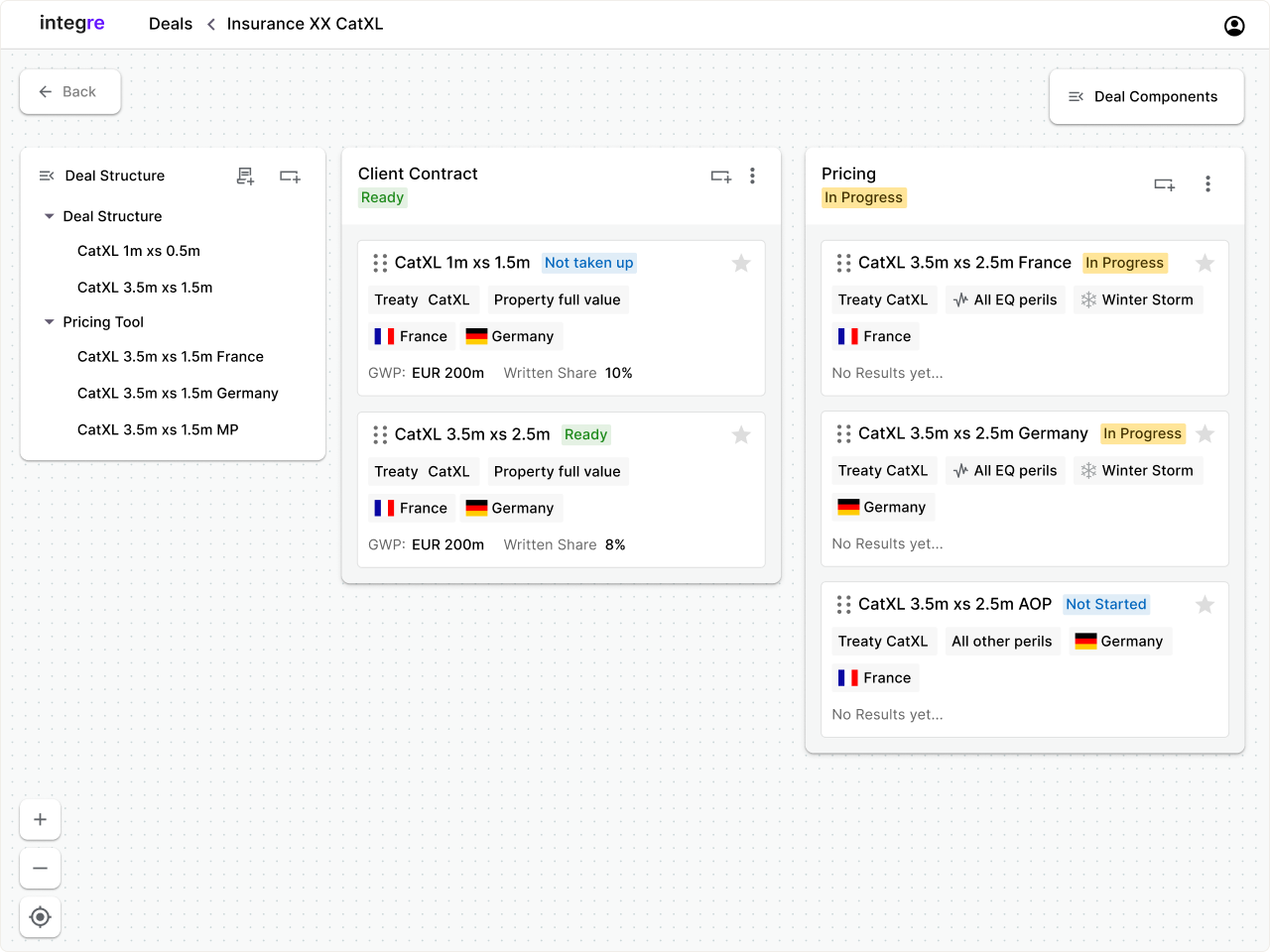

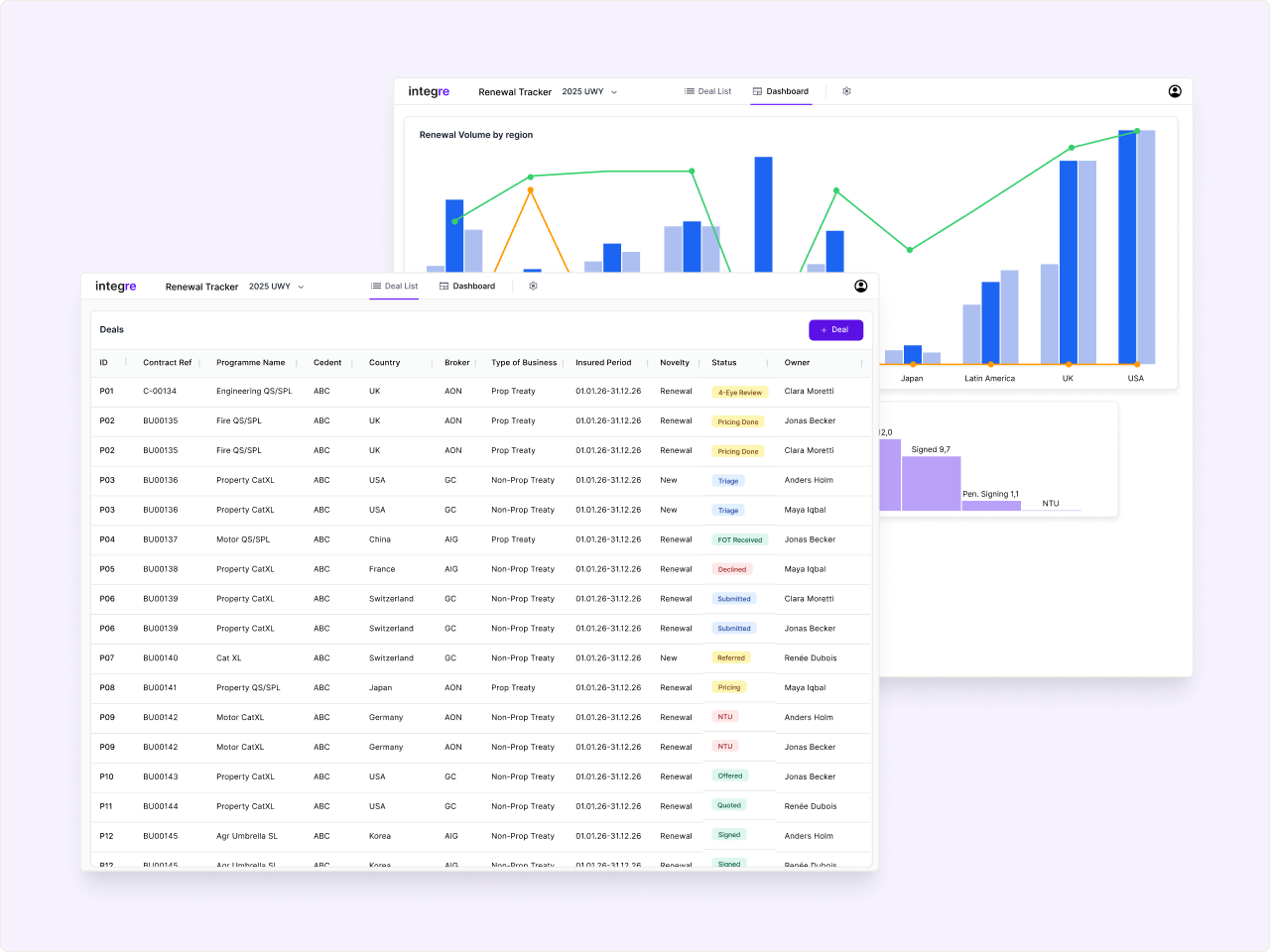

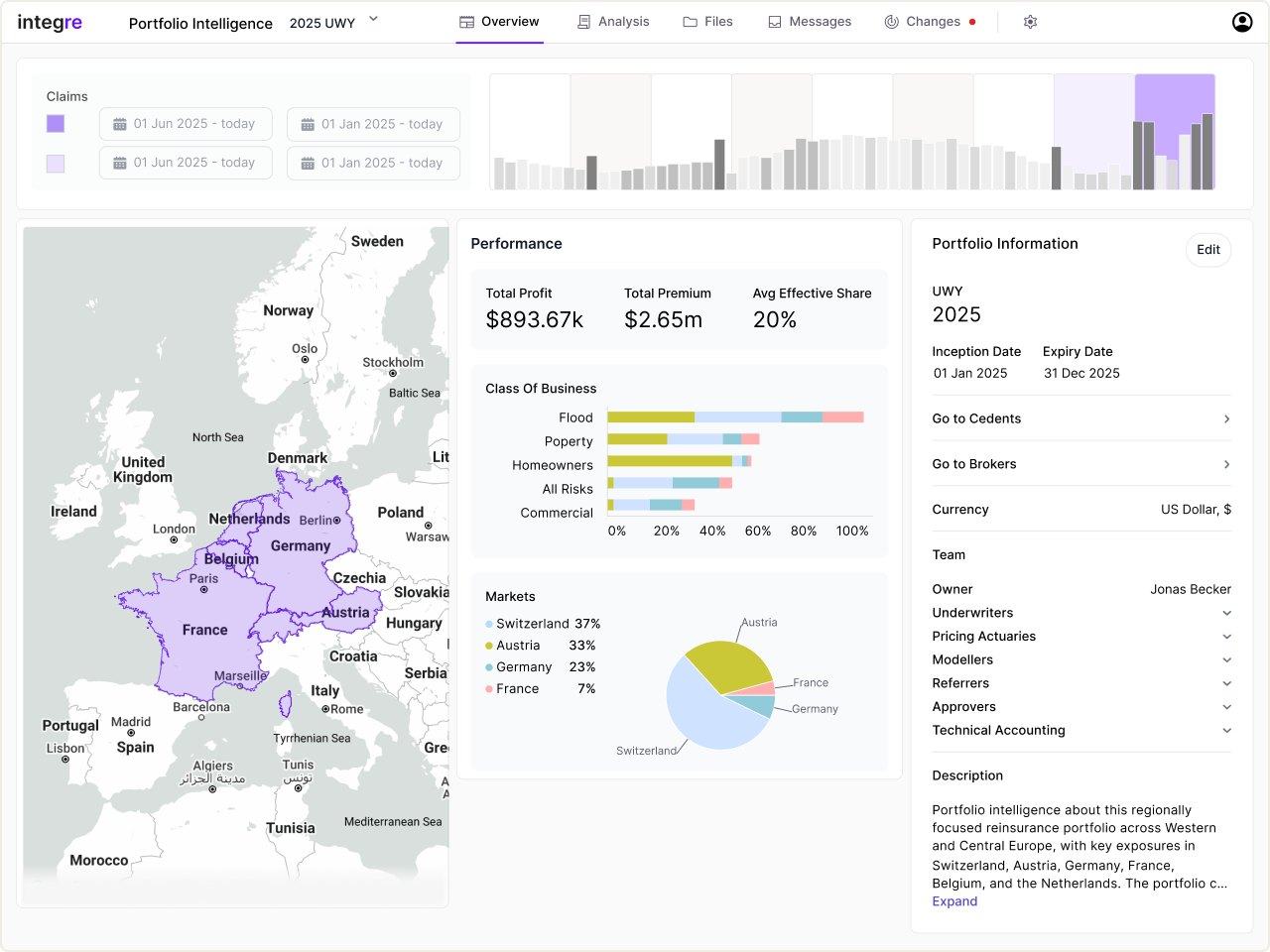

integre is a reinsurance solution built on the principle of integration – linking people, processes, data, and systems across the value chain. With modular components and proven architecture, it enables smarter, connected decisions across underwriting, claims, and portfolio management.